Understanding the 2025 Social Security COLA Increase

The 2025 Social Security Cost-of-Living Adjustment (COLA) is a significant topic for millions of Americans who rely on these benefits. The COLA is designed to protect the purchasing power of Social Security benefits against inflation. It is calculated annually based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of inflation experienced by urban wage earners and clerical workers.

Factors Influencing the Social Security COLA Increase

The Social Security COLA is calculated based on the percentage increase in the CPI-W from the third quarter of the previous year to the third quarter of the current year. For instance, the 2025 COLA will be determined by comparing the CPI-W in the third quarter of 2024 to the third quarter of 2023.

- Inflation: The primary factor influencing the COLA is inflation. If inflation is high, the COLA will be larger to help beneficiaries maintain their purchasing power. Conversely, a low inflation rate will result in a smaller COLA.

- Economic Growth: While not a direct factor, economic growth can indirectly impact the COLA. If the economy is strong, inflation is likely to be higher, leading to a larger COLA.

- Government Spending: Government spending can influence inflation and, consequently, the COLA. Increased government spending can lead to higher inflation, which would necessitate a larger COLA.

- Consumer Spending: Consumer spending is a major driver of inflation. Increased consumer spending can lead to higher demand for goods and services, pushing up prices and, in turn, the COLA.

Potential Impact of Inflation on the 2025 COLA

Inflation has been a major concern in recent years, and its impact on the 2025 COLA is uncertain. While inflation has shown signs of cooling in recent months, it remains above the Federal Reserve’s target rate of 2%.

“If inflation remains elevated, the 2025 COLA could be substantial, providing much-needed relief to Social Security beneficiaries.”

If inflation continues at its current pace or even accelerates, the 2025 COLA could be significant. However, if inflation cools down considerably, the COLA might be smaller than in previous years.

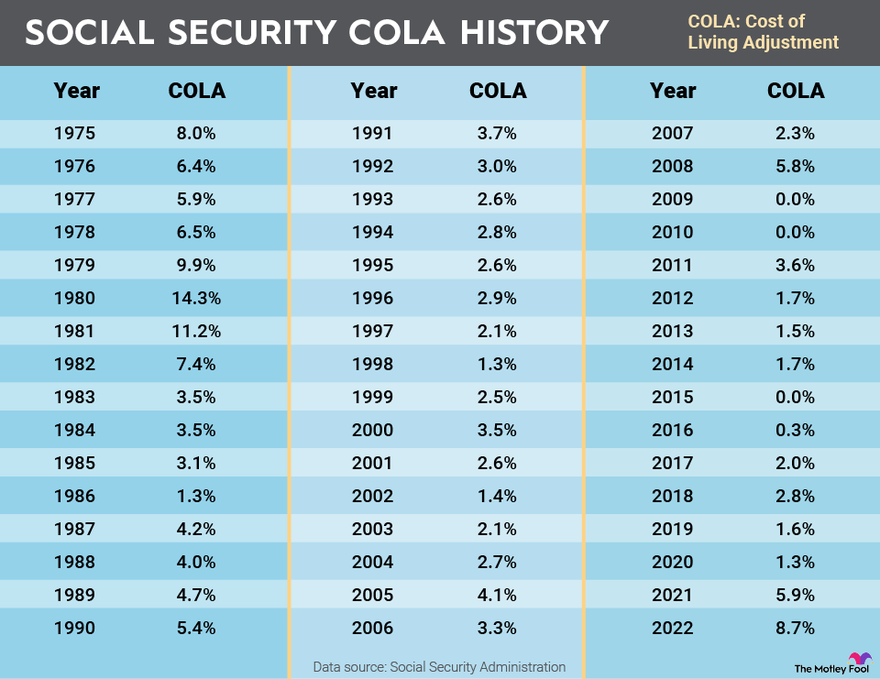

Historical Overview of Social Security COLA Increases in Recent Years, 2025 social security cola increase

| Year | COLA |

|---|---|

| 2023 | 8.7% |

| 2022 | 5.9% |

| 2021 | 1.3% |

| 2020 | 1.6% |

Comparison of the 2025 COLA to Previous Years

The 2025 COLA is expected to be influenced by the inflation rate in the coming months. While it’s impossible to predict the exact amount, it is likely to be compared to the previous years’ COLA increases. If inflation remains elevated, the 2025 COLA could be one of the largest in recent years. However, if inflation subsides, the COLA might be more modest.

Impact of the 2025 COLA Increase on Beneficiaries

The 2025 Social Security COLA increase, while a positive development, is not without its impact on beneficiaries. The increase aims to offset the rising cost of living, but its effects are multifaceted and can be both beneficial and challenging for recipients.

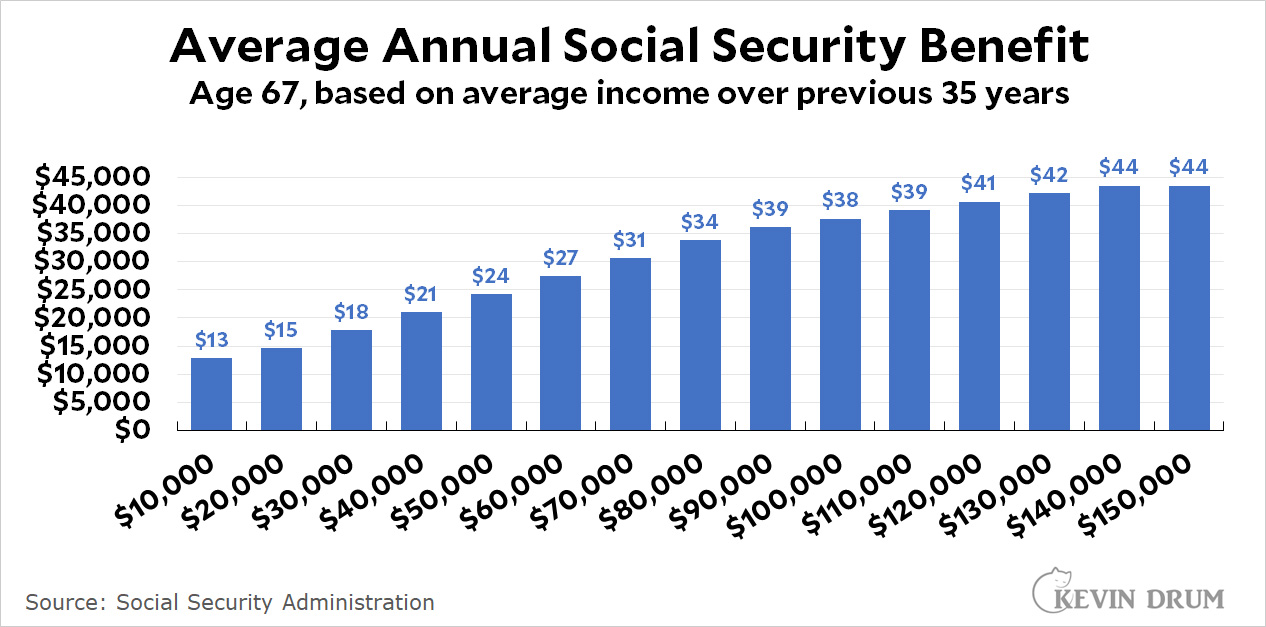

Financial Benefits for Social Security Recipients

The COLA increase translates to higher monthly benefits for Social Security recipients. This extra income can provide financial relief, enabling beneficiaries to cover essential expenses like groceries, housing, and healthcare. For instance, a beneficiary receiving $1,500 per month before the COLA increase might see an additional $100-$200 per month, depending on the specific COLA percentage. This additional income can make a significant difference in managing daily expenses, especially for individuals who rely heavily on Social Security benefits.

Impact of the COLA Increase on the Purchasing Power of Beneficiaries

The COLA increase aims to maintain the purchasing power of beneficiaries by adjusting their benefits to reflect inflation. This means that recipients can theoretically buy the same amount of goods and services with their increased benefits as they could before the increase. However, the effectiveness of the COLA in maintaining purchasing power depends on several factors, including the rate of inflation and the specific items included in the Consumer Price Index (CPI), which is used to calculate the COLA. If the COLA increase does not fully compensate for inflation, beneficiaries might still experience a decline in their purchasing power.

Challenges Faced by Beneficiaries Despite the COLA Increase

While the COLA increase can provide financial relief, it does not necessarily address all the challenges faced by beneficiaries. Despite the increase, many recipients may still struggle with rising healthcare costs, housing expenses, and other essential needs. The COLA increase might not be sufficient to cover these rising costs, especially for individuals with limited financial resources or those living in high-cost areas. Additionally, the COLA increase does not address the long-term sustainability of the Social Security program.

Estimated Monthly Benefits Before and After the COLA Increase

The following table compares the estimated monthly benefits before and after the COLA increase, assuming a specific COLA percentage of 3.5%.

| Benefit Level | Monthly Benefit Before COLA Increase | Monthly Benefit After COLA Increase |

|---|---|---|

| Low | $800 | $828 |

| Medium | $1,500 | $1,552.50 |

| High | $2,500 | $2,587.50 |

It is important to note that these are just estimates and actual benefits may vary depending on individual circumstances and the specific COLA percentage.

Implications for the Social Security Program

The 2025 Social Security COLA increase, while providing much-needed relief to beneficiaries, raises important questions about the long-term sustainability of the program. The increase underscores the need for a comprehensive assessment of the program’s financial health and the potential impact of rising costs on its future.

Long-Term Sustainability

The Social Security program faces a significant challenge in ensuring its long-term sustainability. The rising cost of living, coupled with an aging population, puts increasing pressure on the program’s finances. The 2025 COLA increase, while necessary to maintain the purchasing power of benefits, contributes to the program’s long-term funding challenges.

The Social Security Trustees’ 2023 report projects that the program’s trust funds will be depleted by 2034, at which point benefits will need to be cut by approximately 20% to maintain solvency.

The depletion of trust funds highlights the need for proactive measures to address the program’s financial challenges.

Potential Challenges and Opportunities

The 2025 COLA increase presents both challenges and opportunities for the Social Security program.

Challenges

- Increased program expenditures: The COLA increase will lead to higher program expenditures, further straining the program’s finances.

- Pressure on trust funds: The increase will contribute to the depletion of the program’s trust funds, accelerating the timeline for potential benefit cuts.

- Political complexities: Finding solutions to the program’s financial challenges is a politically complex issue, with various stakeholders advocating for different approaches.

Opportunities

- Enhanced beneficiary well-being: The COLA increase provides much-needed relief to beneficiaries, enhancing their quality of life and reducing poverty among seniors.

- Economic stimulus: Increased Social Security benefits can stimulate the economy by increasing consumer spending.

- Public awareness: The COLA increase can raise public awareness about the importance of Social Security and the need for long-term solutions to ensure its sustainability.

Potential Policy Changes

The 2025 COLA increase underscores the need for policy changes to ensure the long-term sustainability of the Social Security program.

- Raising the retirement age: Gradually increasing the retirement age over time can reduce the program’s long-term costs by extending the period over which individuals contribute to the system.

- Increasing the Social Security tax: Raising the Social Security tax rate or expanding the taxable wage base can generate additional revenue to offset rising program expenditures.

- Reducing benefits for higher earners: Adjusting the benefit formula to reduce benefits for higher earners can help to address concerns about the program’s equity and sustainability.

- Investing trust fund assets: Allowing the trust funds to invest in a broader range of assets, such as stocks and bonds, could potentially generate higher returns and offset future benefit cuts.

Projected Growth of Social Security Expenditures

The following timeline illustrates the projected growth of Social Security expenditures over the next decade:

| Year | Projected Expenditures (Billions of Dollars) |

|---|---|

| 2025 | 1.5 trillion |

| 2026 | 1.6 trillion |

| 2027 | 1.7 trillion |

| 2028 | 1.8 trillion |

| 2029 | 1.9 trillion |

| 2030 | 2.0 trillion |

| 2031 | 2.1 trillion |

| 2032 | 2.2 trillion |

| 2033 | 2.3 trillion |

| 2034 | 2.4 trillion |

The 2025 Social Security COLA increase is a positive step towards ensuring financial stability for millions of Americans. Just as important is creating comfortable spaces in our homes, and a well-chosen chair can make all the difference. If you’re wondering about the right chair height for a 30-inch table, check out this helpful guide: what height chair for 30 inch table.

A comfortable dining experience is just as vital as financial security, and we can all strive for both in the new year.

While we await news on the 2025 Social Security COLA increase, let’s focus on empowering the next generation. A Montessori weaning table and chair, like those available from montessori weaning table and chair australia , fosters independence and self-confidence in young eaters, preparing them for a brighter future.

Just as we strive for a secure future for our seniors, let’s invest in the well-being of our children, ensuring a prosperous future for all.